is inheritance taxable in utah

Sales taxes in Utah range from 610 to 905 depending on local rates. Processed items - Such as products that were processed by third parties and have more value than their original precious metals content eg.

A Guide To Inheritance Tax In Utah

Maryland is the only state to impose both.

. Taxable unearned income may include. If the grantor acted as trustee while he was alive the named co-trustee. Overall taxpayers in Utah face a relatively low state and local tax burden.

What Are Allowable Deductions. Colorized coins black rutheniumgold plated coins etc Iowa State Information. However state residents must remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1206 million in 2022 2412 million for couples.

Profit from the sale of assets. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. An inheritance tax is a state-imposed tax that you pay when receiving money or property from a deceased persons estate.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Does Utah Have an Inheritance Tax or an Estate Tax. Utah has a flat tax.

Thus saving money on property taxes and maximizing your inheritance. Twelve states and Washington DC. Unlike an estate tax beneficiaries pay the inheritance tax and it is usually due shortly after funds are received by the beneficiary.

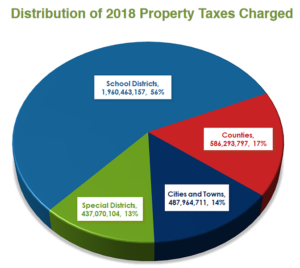

Salt Lake City Utah 84106 801 467-4450. Homeowners in Utah also pay exceptionally low property taxes with an average effective rate of just 058. Fortunately these taxes are almost a thing of the past.

Of course municipal bonds usually earn less income than other taxable bonds but they can still be a worthwhile strategy for reducing your tax burden. The site is secure. The Kindest States for Lottery Taxes Your best bet for avoiding lottery taxes is to live in a state that doesnt have an income tax at all as of 2022.

Other states that dont participate in Powerball are Alabama Alaska Idaho Nevada and Utah. Other items taxable under Indiana state law include. Utah does not collect an estate tax or an inheritance tax.

632 North Main Street Logan Utah 84321 435 750-5566. Accessories - Such as holders tubes coin flips and similar apparel. It is possible to reduce taxable income by contributing to a retirement account like a 401k or an IRA.

Taxable 175 state tax plus mandatory 125 in local and county taxes Clothing. Impose estate taxes and six impose inheritance taxes. Inheritance and Estate Taxes.

Minnesotas estate tax exemption is 3 million but the state looks back to include any taxable gifts made within three years prior to. Florida South Dakota Texas Washington Tennessee and Wyoming. Business and farm income.

When the maker of a revocable trust also known as the grantor or settlor dies the assets become property of the trust. The https ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. The state of Utah has a single personal income tax with a flat rate of 495.

Utah Estate Tax Everything You Need To Know Smartasset

How Do Probate Records Show Probate Family Law Attorney Divorce Lawyers

Demystifying Utah S Property Tax Law And Why We Have The Best Property Tax Laws In The Nation Utah Taxpayers

Spanish Inheritance Tax Who Gains Spanish Flags Flag Photo National Flag

What Is An Undisputed Divorce In Utah Utah Divorce Divorce Lawyers Divorce Settlement

Utah Estate Tax Everything You Need To Know Smartasset

Estates And Trust Services 801 676 5506 Free Consultation Tax Lawyer Inheritance Tax Divorce Attorney

Utah Estate Inheritance Tax How To Legally Avoid

Children S Rights In Divorce Divorce Utah Divorce Divorce Lawyers

Voices For Utah Children State Estate Taxes A Key Tool For Broad Prosperity Estate Tax Inheritance Tax Prosperity

Utah Estate Tax Utah Inheritence Tax Credit Shelter Trust Gift Tax

Adoption Taxpayer Identification Number Family Law Attorney Divorce Lawyers Divorce Attorney

Utah Inheritance Laws What You Should Know

Utah State Income Tax Calculator Community Tax

State Estate Tax In Utah Shand Elder Law

A Guide To Inheritance Tax In Utah

Capital Gain Tax In The State Of Utah What You Need To Know Capital Gains Tax Capital Gain Education Savings Account