are 529 college savings plans tax deductible

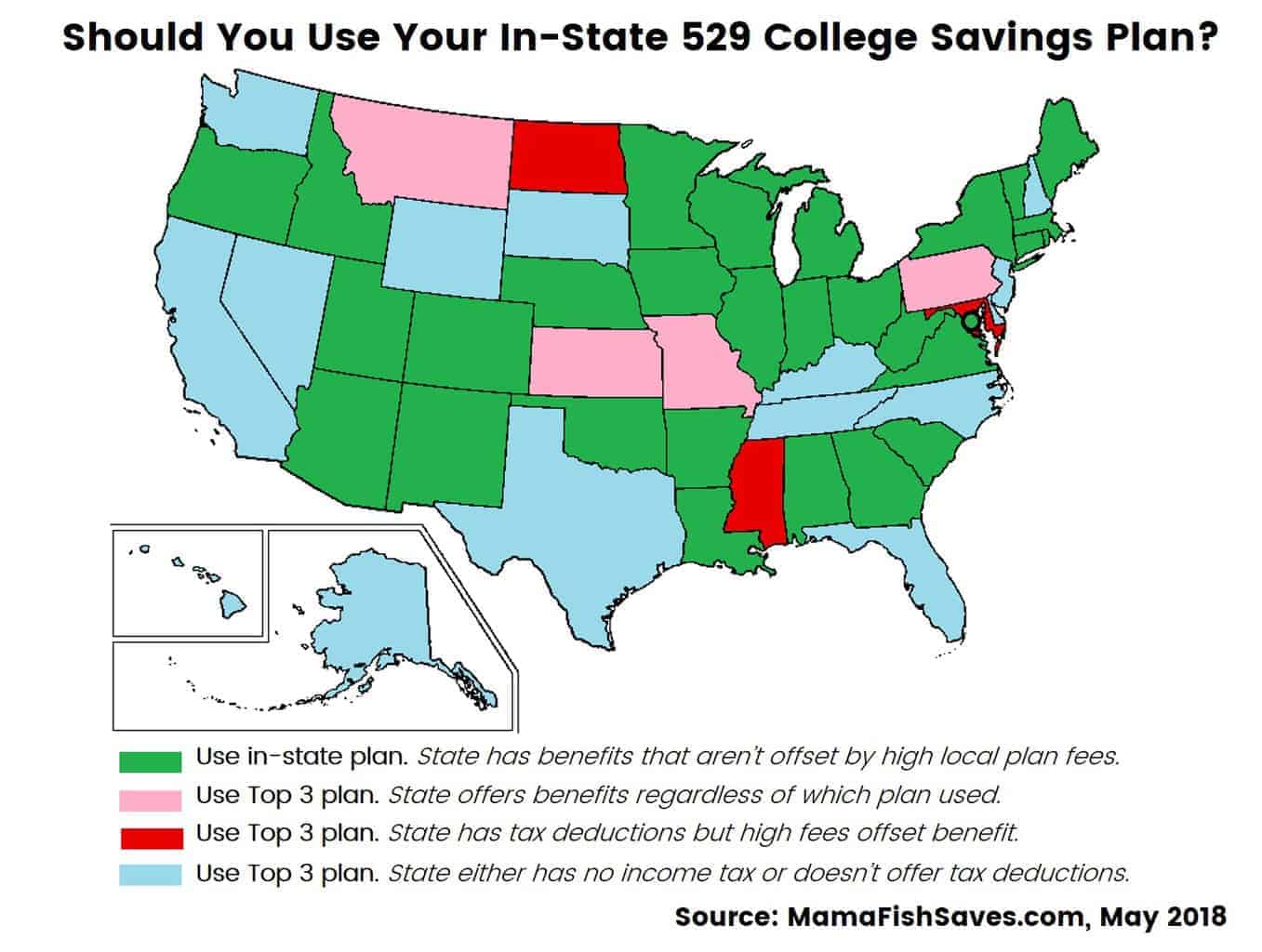

Use the 529 plan state tax calculator from Merrill to help you determine your 529 tax deductions savings and. However some states may consider 529 contributions tax deductible.

Can I Use A 529 Plan For K 12 Expenses Edchoice

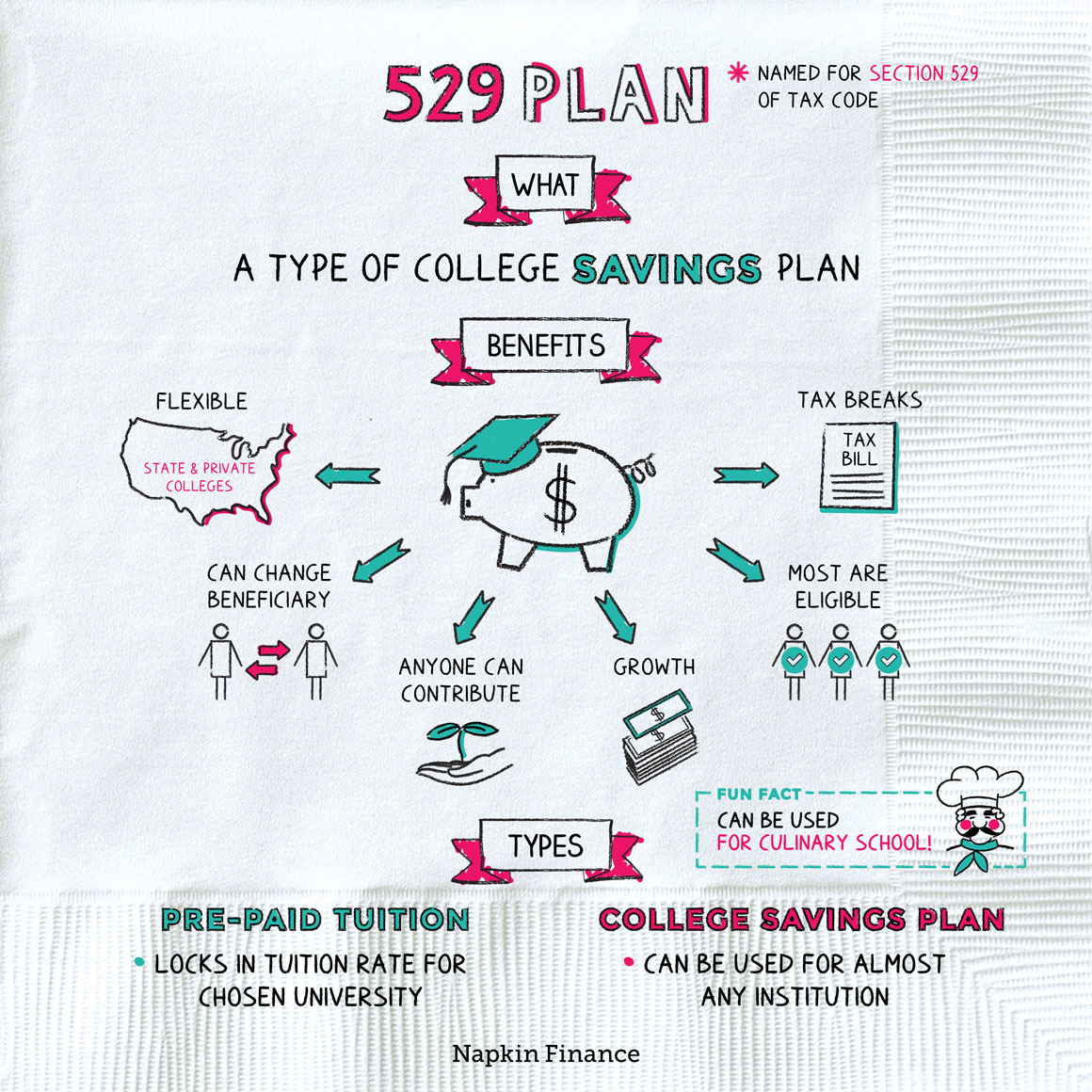

529 plans legally known as qualified tuition plans are sponsored by states state.

. Yes grandparents can claim the deduction for contributing to a 529 if they live in one of the 34 states that offer a state income tax deduction for 529 college-savings plan. Although your contributions to a 529 College Savings Plan are not tax deductible. As a result many families may be missing out on a.

The Path2College 529 Plan operated under the Georgia Office of the State Treasurer gives you a way to start saving today to prepare for a childs tomorrow. The ONLY FDIC-insured 529. Protects your principal and guarantees an annual rate of return of 179 for calendar year 2022 net of all fees.

The Path2College 529 Plan is. The tax advantages associated with these savings accounts make them one. Never are 529 contributions tax deductible on the federal level.

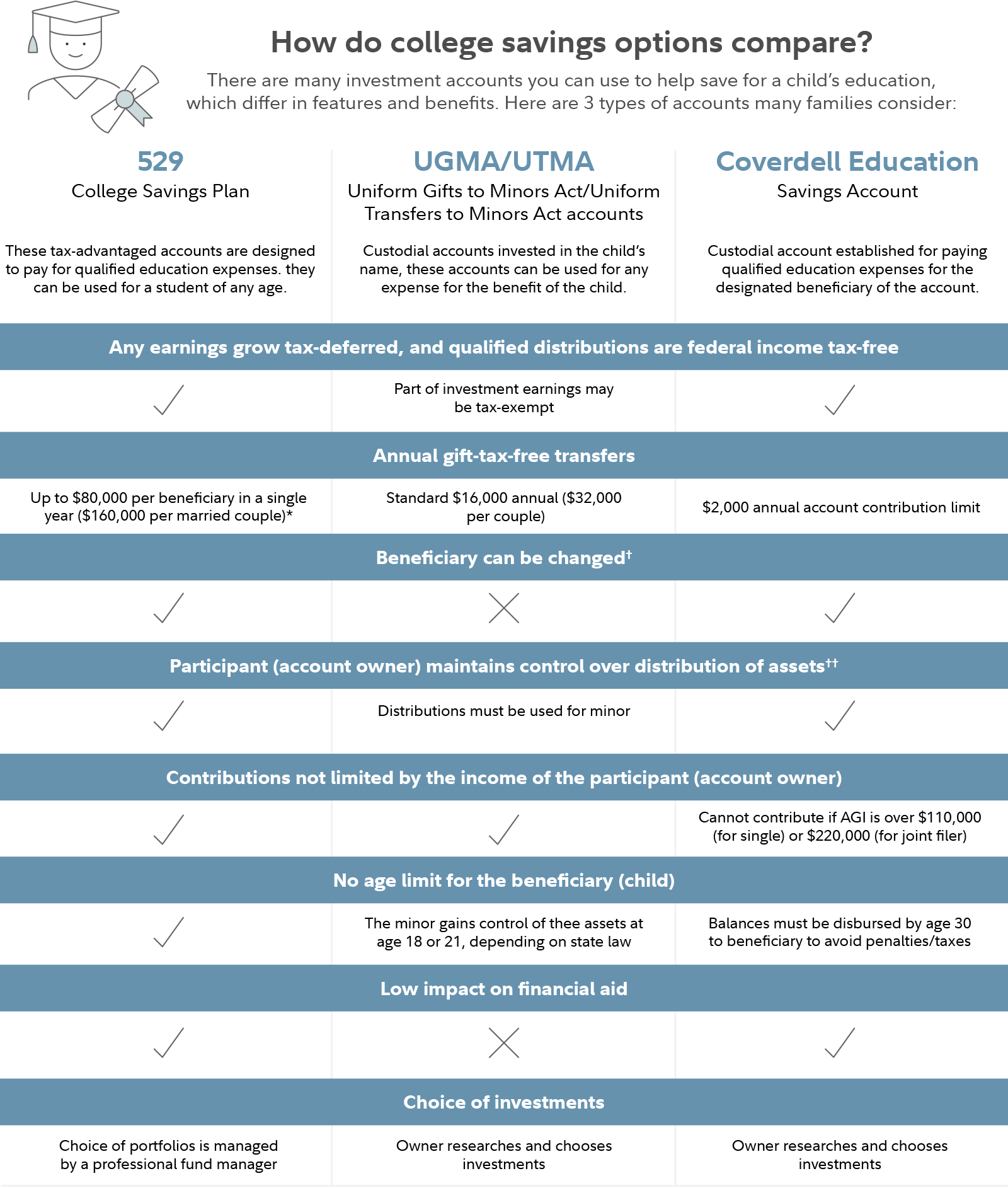

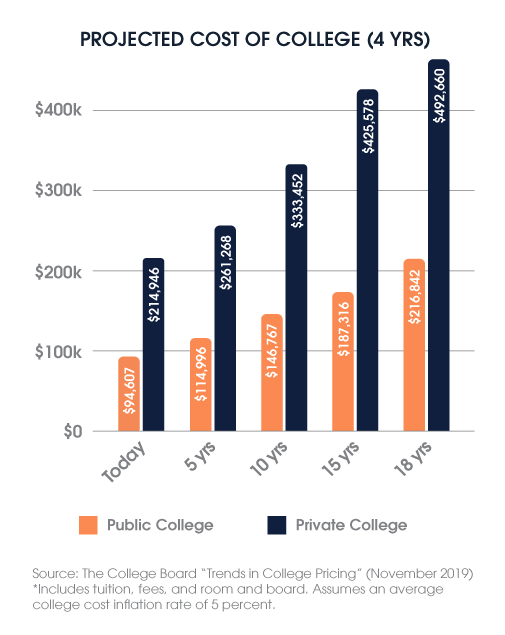

529 plans tax-advantaged investment vehicles meant to help families save for college are often misunderstood. A 529 plan is a tax-advantaged savings account that can be used to save and pay for eligible college expenses. Check with your 529 plan or your state.

Section 529 permits withdrawals from 529 college savings accounts up to an aggregate of 10000 per year per student for tuition expenses in connection with enrollment at a K-12. 529 plan contributions arent typically tax-deductible but they are exempt from federal. Oregon College Savings Plan Tax Deduction LoginAsk is here to help you access Oregon College Savings Plan Tax Deduction quickly and handle each specific case you encounter.

Owners of 529 plans may also qualify for state-level tax deductions. A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. Tax-favored Section 529 college savings plans also known as qualified tuition programs have been around long enough that many people are now withdrawing money to.

Many states offer tax deductions for 529 plans. Your contributions to a 529 plan arent tax-deductible on a federal level but might be on the state level. States vary when it comes to tax deductions and savings for 529 plans.

A 529 plan is an excellent option to start saving for your childs college education early. Federal Tax Deduction for 529 Plans. For the 2022 tax year the maximum deduction is 3560 per year per beneficiary for marriedjoint filers 1780 for married filing separate status and divorced parents of a beneficiary.

What Is A 529 Plan Napkin Finance

Michael W Frerichs Illinois State Treasurer College Savings

How Much Are 529 Plans Tax Benefits Worth Morningstar

Taxes Faqs Oregon College Savings Plan

Can You Get A 529 Plan Tax Deduction

Tips On Spending The Money In College Savings Accounts The New York Times

What Is A 529 Plan Marcus By Goldman Sachs

/istock485330694.college.plan.cropped-5bfc32b946e0fb00260c7688.jpg)

How New Tax Changes Promote 529 Investments

Pre Tax Funding For College Education Under The Tax Cuts Jobs Act Clark Nuber Ps

Oregon College Savings Plan Tax Deduction Limits For 2013 Oregonlive Com

Choosing The Best 529 College Savings Plan For Your Family Smart Money Mamas

Is There A Tax Deduction For 529 College Savings Plan

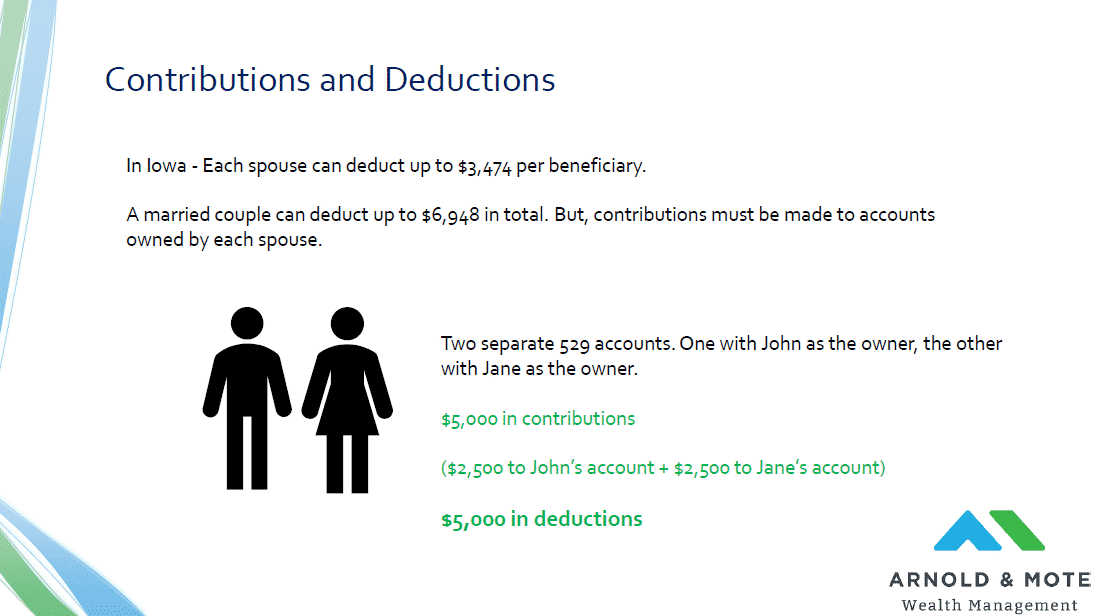

Iowa 529 Beyond The Basics Of Iowa S College Savings Plan Arnold Mote Wealth Management

Saving For College Answers To Your 529 Plan Questions

Understanding 529 College Savings Plans First Interstate Bank

Why A 529 College Savings Plan T Rowe Price